Pretoria remains mum as new 10% US import levy looms after court blocks Trump tariffs

The ruling effectively blocks one of the central pillars of Trump’s trade strategy while setting the stage for a potentially lengthy legal battle over tariff refunds

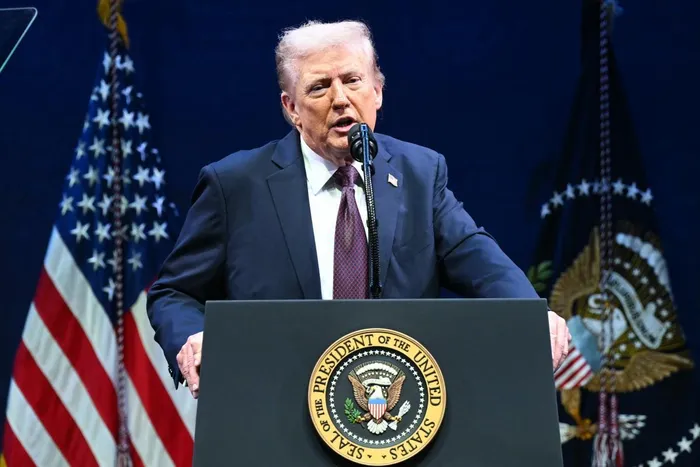

Image: AFP

The South African government has opted to remain tight-lipped following a landmark ruling by the US Supreme Court that struck down US President Donald Trump’s sweeping “Liberation Day” tariffs, even as trade negotiations between Pretoria and Washington continue behind closed doors.

In a 6–3 decision on Friday, the court ruled that Trump exceeded his authority by using the International Emergency Economic Powers Act (IEEPA) to impose broad tariffs without congressional approval.

The justices held that IEEPA “does not authorise the President to impose tariffs,” adding that if Congress had intended to grant such “distinct and extraordinary power,” it would have done so explicitly, as it has in other trade statutes.

The ruling effectively blocks one of the central pillars of Trump’s trade strategy while setting the stage for a potentially lengthy legal battle over tariff refunds. The now-invalidated duties reportedly generated between $133 billion and $175bn from January 2025 to mid-December.

Harold Krent, a professor at Chicago-Kent College of Law and author of Presidential Powers, described the judgment as a decisive moment. He called it a victory for free trade and a firm rejection of what he characterised as an expansive view of presidential authority.

“The Supreme Court's tariffs decision is not only a striking defense of free trade but, more importantly, it squarely rebuffs President Trump’s embrace of a virtually unrestrained Presidency,” Krent said.

Financial markets, meanwhile, are interpreting the ruling as a turning point.

Nigel Green, CEO of global advisory firm deVere Group, said the president’s signature economic agenda now appears to be under constitutional and economic strain.

“This ruling strikes at the core of the administration’s economic doctrine,” Green said. “Tariffs were positioned as the engine of renewed domestic strength. Instead, they have functioned largely as a tax on importers, with many passing costs directly to consumers.”

Green added that policy uncertainty has squeezed corporate margins in sectors dependent on global supply chains and delayed investment decisions, even as markets may rally in response to reduced trade tensions.

In Pretoria, officials are watching developments carefully. South Africa has been in talks with Washington after Trump last year announced tariffs exceeding 30% on certain South African exports to the US.

However, Kaamil Alli, spokesperson for the Minister of Trade, Industry and Competition, declined to comment on the latest ruling on Saturday, saying the department had “no comment at this stage.”

Despite the court setback, Trump moved swiftly to recalibrate his trade strategy. Within hours of the ruling, he signed a proclamation under Section 122 of the Trade Act of 1974, imposing a 10% ad valorem import duty on most goods entering the United States for 150 days, effective February 24.

“Effective immediately, all national security tariffs under Section 232 and existing Section 301 tariffs remain fully in place,” Trump said at a media briefing. “Today I will sign an order to impose a 10% global tariff under Section 122 over and above our normal tariffs already being charged.”

He insisted the court had not overruled tariffs altogether, but merely restricted a specific use of IEEPA.

“Foreign countries that have been ripping us off for years are ecstatic. They're so happy and they're dancing in the streets but they won't be dancing for long,” Trump said.

The introduction of the temporary 10% global duty creates a new layer of complexity for global traders.

While the invalidation of the original “Liberation Day” tariffs removes one source of uncertainty, the Section 122 action signals that protectionist measures remain central to the administration’s trade policy. For South Africa, the short-term implications may be mixed.

Donald McKay, CEO of XA International Trade Advisors, said the court’s decision is positive but cautioned that the broader policy direction remains fluid.

“The court case has been lost, which is of course a very good thing,” McKay said.

On South Africa’s prospects, McKay noted that if the new flat 10% tariff is imposed across the board, the African Growth and Opportunity Act (Agoa) preferences could regain relevance.

Agoa allows eligible sub-Saharan African countries preferential access to the US market, typically reducing underlying duties that average around 3.5%.

“If we get the Agoa preference on the underlying duty rate and the 10% is applied on top of that, then suddenly we’re back in the game,” he said.

Still, McKay stressed that the longer-term risks remain. He said Trump has other trade tools at his disposal, including Section 232 national security tariffs and Section 301 investigations.

"But all of these come with additional burdens, either with expiry or the requirement to have a proper investigation. And so he could do it, but it would be much harder to do and much harder to maintain," McKay said.

BUSINESS REPORT